Get the free ss10 form

Show details

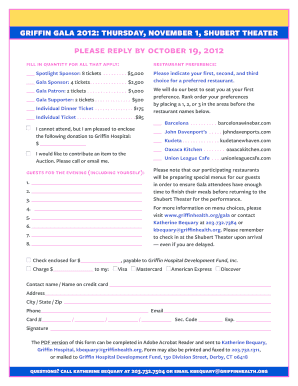

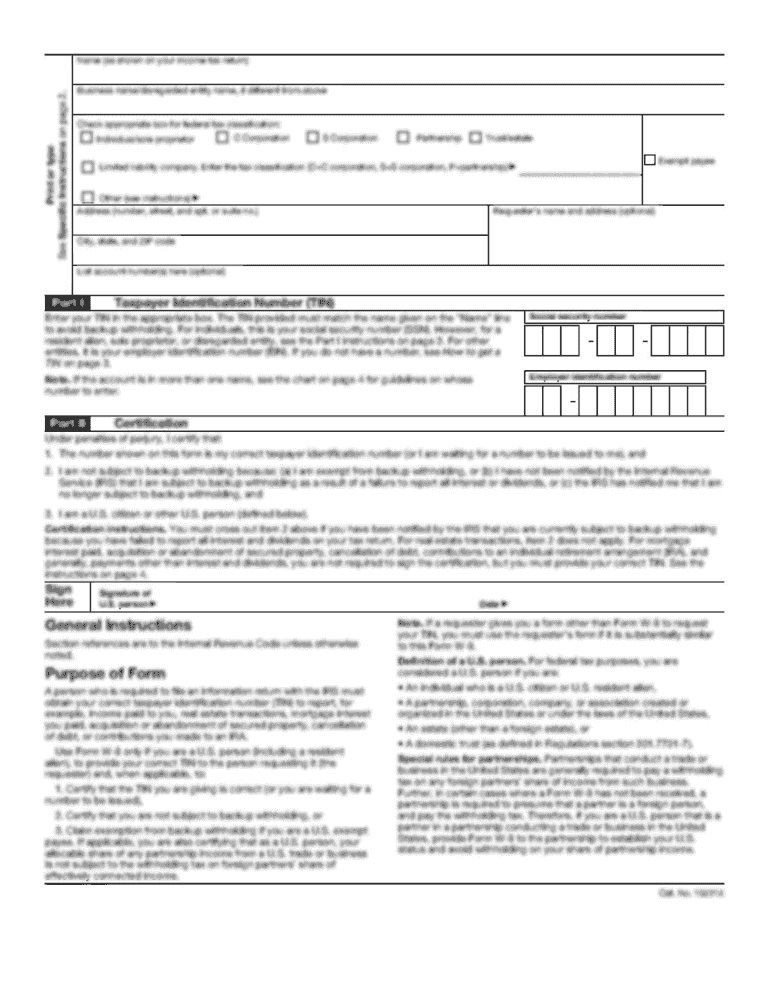

BY Authorized Official Signature and Title - See instructions. Signature instructions are on the back of this form www.irs.gov Catalog No. 20030G Form SS-10 Rev. 12-2004 Instructions If this consent is for a partnership return only one authorized partner need sign. If you are an attorney or agent of the taxpayer s you may sign this consent provided the action is specifically authorized by a power of attorney. Form SS-10 Rev. Dec. 2004 Department ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ss10 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ss10 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ss10 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ss s forms online. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out ss10 form

How to fill out SS10 form:

01

Obtain a blank SS10 form from the Social Security Administration website or a local Social Security office.

02

Fill in your personal information accurately, including your full name, Social Security number, date of birth, address, and contact information.

03

Provide information about your employer or previous employer, including their name, address, and contact information.

04

Indicate the reason for completing the form, whether you are applying for a Social Security card for the first time or requesting a replacement card.

05

If you are requesting a replacement card, provide a brief explanation of why you need a new card (e.g., lost, stolen, damaged).

06

Sign and date the form.

07

Review the completed form for accuracy and make any necessary corrections before submitting it.

Who needs SS10 form:

01

Individuals who have never been issued a Social Security card and need to apply for one.

02

Individuals who have lost, misplaced, or had their Social Security card stolen and need a replacement card.

03

People who are requesting a new Social Security card due to a name change, such as after marriage or divorce.

04

Individuals who are legally changing their name and need a new Social Security card with the updated name.

05

Anyone who needs to update the information on their existing Social Security card, such as a change in address or contact information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ss10 form?

SS10 form is a specific form used by the United Kingdom government's Department for Work and Pensions (DWP) to apply for a Social Security Pension Forecast.

The Social Security Pension Forecast provides individuals with an estimate of the state pension they may receive when they reach retirement age. It helps people plan for their retirement by providing information on how much pension they can expect to receive and when they can claim it.

The SS10 form is filled out by individuals who want to know their entitlement to the state pension but have not yet reached the age at which they can claim it. It requires personal information such as name, address, date of birth, National Insurance number, and information about your employment history.

Who is required to file ss10 form?

Form SS-10, also known as the Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, is filed by a business or organization to request a determination from the Internal Revenue Service (IRS) regarding the classification of a worker as an employee or an independent contractor. This form is typically filed by employers or businesses who are unsure of how to classify a worker. By filing Form SS-10, they seek guidance from the IRS to determine the appropriate tax treatment and obligations for that worker.

How to fill out ss10 form?

To fill out Form SS-10, you can follow these steps:

1. Obtain a copy of Form SS-10 from the official website of the Internal Revenue Service (IRS) or any authorized source.

2. Make sure you have all the necessary information before starting to fill out the form. This may include:

a. Information about the individual or entity that is classifying their workers as employees or independent contractors.

b. Information about the workers being classified, such as their names, addresses, and Social Security numbers.

c. Detailed information about the nature of the working relationship between the individual or entity and the workers, including the type of services provided, contract terms, control over work, payment methods, etc.

3. Read the form carefully to understand the instructions and requirements for each section.

4. Provide all the requested information in the appropriate fields. Make sure to complete the form accurately and thoroughly, providing detailed explanations where necessary.

5. Review the completed form for any mistakes or missing information. Double-check the accuracy of names, addresses, and Social Security numbers.

6. Sign and date the form as required. If you are filling out the form on behalf of an entity, you may need to include your title or capacity within the organization.

7. Make copies of the completed form for your records.

8. Submit the completed Form SS-10 to the appropriate IRS address. Refer to the instructions for the specific mailing address where the form should be sent.

Remember to consult with a qualified tax professional or seek advice from the IRS if you have any specific questions or concerns while filling out Form SS-10.

What is the purpose of ss10 form?

The purpose of the SS10 form, also known as the Registration of a Trust, is to provide the necessary information to the Social Security Administration (SSA) when establishing a trust account. This form is submitted by the trustee or authorized representative of the trust and helps the SSA determine the eligibility of beneficiaries for various social security benefits. The form includes details about the trust assets, beneficiaries, trustees, and relevant information needed to process the application.

What information must be reported on ss10 form?

The SS-10 form, also known as the "Worker Classification Determination" form, is used to request an official determination from the Internal Revenue Service (IRS) regarding the employment status of a worker for federal tax purposes. The information that must be reported on the SS-10 form includes:

1. Identification Information: This includes the name, address, and taxpayer identification number (TIN) of the business, as well as the name and contact information of the requester.

2. Worker Information: This section requires detailed information about the specific worker in question, including their name, address, TIN or Social Security number, and a description of the services they provide.

3. Employment Relationship: This section requires the requester to provide information about the nature of the working relationship between the business and the worker, including the dates and duration of the services provided, the method of compensation (e.g., hourly rate, project-based, etc.), and any prior or existing employment agreements.

4. Business Operations: The requester must provide information about their business operations and how they engage with other workers, such as whether they have employees, subcontractors, or both.

5. Reason for Request: This section requires the requester to explain the reason for seeking a determination from the IRS, providing details about any previous IRS audit or inquiry related to worker classification, or any upcoming corporate acquisitions or restructuring that may be affected by the determination.

6. Signature and Certification: The requester must sign and certify that the information provided in the form is true and accurate to the best of their knowledge, under penalty of perjury.

It is important to note that the SS-10 form is used to request an official determination from the IRS, and it does not in itself classify a worker as an employee or an independent contractor. The IRS reviews the information provided on the form and makes a determination based on the specific facts and circumstances of the employment relationship.

What is the penalty for the late filing of ss10 form?

The penalty for late filing of the SS-10 form (Application for Employment Identification Number) can vary depending on the specific circumstances and the discretion of the Internal Revenue Service (IRS). However, the penalty is generally $50 for each month or part of a month the failure continues, up to a maximum of $500 per return. It's important to note that this penalty is subject to change, and it's recommended to consult the most recent IRS guidelines or consult with a tax professional for the most accurate and up-to-date information.

How can I edit ss10 form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ss s forms online.

How can I fill out form ss 10 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your print ss10 form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit ss10 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ss s forms online from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your ss10 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ss 10 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.